Today, we're diving deep into the global real estate landscape, drawing on the keynote address delivered yesterday by Maximilian Eves-van den Akker, Global Real Estate Solutions Director at Schroders Capital, at the Investment Management and Pensions Forum.

Max gave us a fantastic overview of where the money is moving and what defines success in this new cycle.

The Good News: We’ve Hit the Soft Landing

According to Max started by saying that unlike the complete loss of faith we saw during the Global Financial Crisis, investors still have fundamental demand for real estate, although they are definitely more selective now.

The big takeaway on the macro front is that we believe we have now achieved a “soft landing”.The operating fundamentals—things like occupancy rates and the rents derived from those assets—have remained largely unchanged. We haven’t seen a massive fallout in the underlying story.

When you put that stability together with the capital market story—which is now providing lower input prices and lower acquisition costs—you get strong cash flows and stable yields. That combination makes real estate a very attractive asset class today.

The Great Correction: Have We Reached the Bottom?

We have been through one of the largest corrections globally in terms of Net Asset Values (NAVs) on appraised asset values. This is unprecedented, and it happened in almost all markets simultaneously. T he European continent was the first to correct asset prices, while the US has taken longer and hasn’t corrected quite as far as Europe.

But here is the confidence level: Schroders Capital is "quite confident" that we have now started to see the bottom of the market, and we are now growing through this period.

The Price Puzzle: Book Value vs. Trading Price

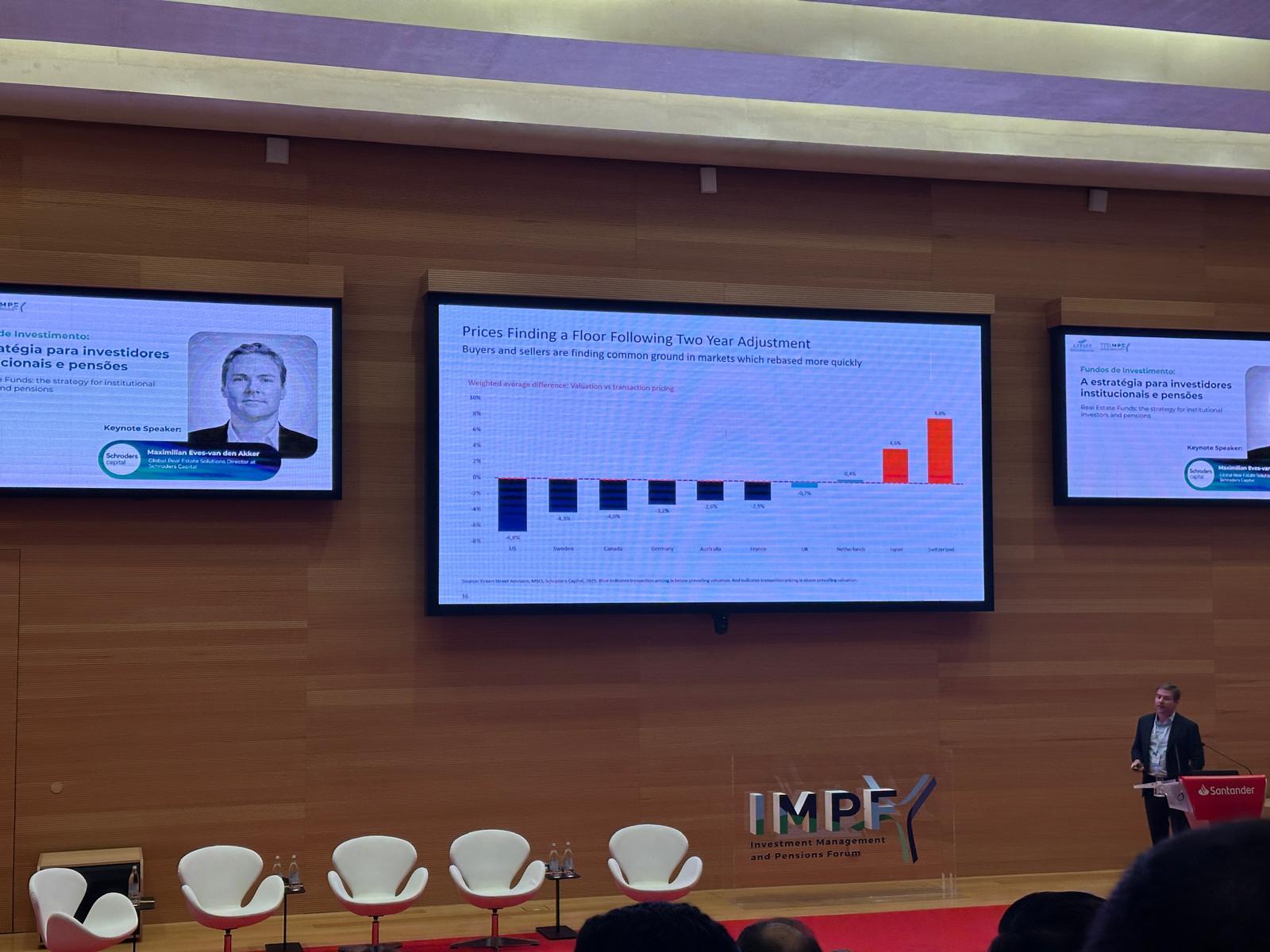

It’s one thing to talk about book valuations, but what price are assets actually trading at? There's still a real difference, especially in certain regions.

If you look at the US today and you're investing, you are expecting to see discounts over and above the already discounted book values. For an active transaction, you might expect an additional 6% to 10% off the book price. That tells you the gap between buyer and seller expectations is still "very, very alive" in the US.

However, in markets like the UK and the Netherlands, they corrected very quickly, which has restricted the difference between buy and sell expectations to around 1%. That is what they call high-conviction investing.

Japan and Switzerland, largely due to monetary policy moving in the opposite direction, have acted as stores of value. Assets in Switzerland have been seen trading at significant premiums purely because the currency is stable, making them a good place to store capital in a high-inflation environment.

Inflation, Construction, and the Supply Squeeze

Inflation has been the story, and real estate is ideally positioned to be an inflation hedge.

Why? Because even though COVID supply bottlenecks are largely over, key input prices for construction materials like steel and cement have rebased about 50% above their prior levels. Layer on top of that higher financing costs, greater uncertainty, and very tight labor supply for young construction workers. This combination makes it very hard to make a case for new development.

But the key economic relationship holds true: construction costs only tend to run ahead of property rents for very short periods of time. This means that rents will rebase to catch up to inflation. That is the fundamental reason why real estate is an ideal hedge for 5, 10, or 20-year time horizons.

This difficult environment for developers leads to the supply story: new real estate stock pipelines are at cyclical lows. New supply is extremely low—only about 1.5% to 3% of the total stock. Crucially, based on US data, that supply pipeline is going to be even more suppressed over the next three years. Since those construction applications haven't gone in, new supply cannot be delivered inside a 3-to-5-year window. If you’re an investor today, you have "incredible assurance" that new competition won't immediately hit the market.

The Proliferation of Sectors and the Focus on Service

We've moved beyond the traditional sectors (office, retail, industrial). There is a "real proliferation of sub sectors". We’re now talking about medical offices, life sciences buildings, senior housing, and data centers—all key for institutional diversification.

We know office markets have been the hardest hit globally due to the work-from-home phenomenon. Meanwhile, markets like hotels, which had already rebased post-COVID, have shown great resilience.

The biggest change, though, is what determines success. In 2021, sector selection was the major driver of returns. Today, that is falling back. Success is much more contingent on selecting the right assets in the right locations. This highlights the importance of partnerships: if Schroders Capital doesn't have a platform in a market, like Portugal, they would only invest by working with an operating partner who truly understands that local market.

And finally, how we manage assets has changed. The focus used to be simply on asset management. While sustainability is still a factor—especially in Europe where regulations like the EPC C rating in the Netherlands by 2030 have real financial implications—the biggest push now is operationalization and service. A modern office building must deliver services and amenities, much like a hotel. This service approach is operationally extensive and requires dedicated teams.

Investment Timing and Vehicles

Historically, periods of investment at the top of the market (like 2006/2007) tend to underperform, while those invested shortly after tend to do well.

The current view is that the next couple of years are the period to get back into positive territory. Prices have stabilized, financing is normalizing, and investor appetite is back.

There are many ways to invest—REITs, open-ended funds (which are the preeminent way), closed-ended funds, and direct investment. But for most, funds remain the preferred route. Funds offer day-one diversification and outsource decision-making. Max shared that big investors who previously insisted on direct investments have actually come back to funds because they "don't want the headache" of being called every few months to make decisions or inject more capital.

Comments